India's central bank , Reserve Bank of India (RBI), is the major pillar of financial markets in the country and thus the economy as a whole. It is responsible for framing of monetary policy which has an ultimate impact on liquidity and interest rates in the financial system.

Among the several goals of RBI , controlling inflation is one of the most important. When inflation is rising and intimidating to twist out of manageable state, as it is today, the RBI role comes into picture. Generally in such a situation it ‘tightens’ the monetary policy which means reducing the amount of liquidity (money supply or floating money) in the economy.

The complete effect of the policies adopted by RBI take some time to show the result , which may be one year or so, but still it is considered as the most effective way to control such macroeconomic issues.

Now the question arises as to how RBI control the floating money in the economy. Among several tools of monetary policy two of the most important are the cash reserve ratio (CRR) and the liquidity adjustment facility (LAF). Liquidity Adjustment Facility is a kind of policy that allows banks to borrow money through repurchase agreements. These are used to aid banks in resolving any kind of short-term cash shortages during periods of economic instability or from any other form of stress caused by any forces which are beyond their control. In other words, it allows banks to respond to liquidity pressures in an efficient manner and hence it is used by governments to assure basic stability in the financial markets.

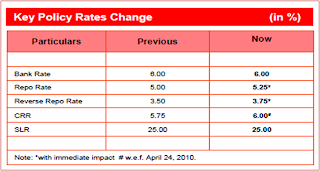

Some of the steps taken by RBI in order to tighten the monetary policy includes raising of the Interest rates such as the repo rate and the reverse repo rate in recent months and the hike in Cash Reserve Ratio.

Beside this , another major step taken by RBI was to stop buying dollars in the international market and hence allow the rupee to rise against the dollar. It is believed that this step would control inflation. The rational behind this kind of belief is that if rupee appreciates then goods and services which are imported into the country would be accessible at cheaper prices in the domestic markets and simultaneously the condition for export will become unfavourable to some extent .This would reroute some of the goods, which were earlier exported, to the domestic markets and hence support the supply side constraints which is the reasons for high inflation. So essentially, RBI has taken steps for the benefit of the economy as a whole by controlling inflation. But the interests of the exporters and thus the balance of payment of the country are still a matter of concern.